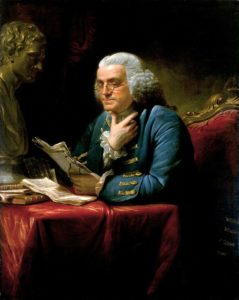

WITH THE FOURTH OF JULY JUST AROUND THE CORNER, I thought it would be appropriate to revisit the wisdom of America’s first personal finance author — and an author of the Declaration of Independence — Ben Franklin.

WITH THE FOURTH OF JULY JUST AROUND THE CORNER, I thought it would be appropriate to revisit the wisdom of America’s first personal finance author — and an author of the Declaration of Independence — Ben Franklin.

Franklin lived in the 1700s, but it turns out that virtually everything he had to say on the topic of money is as applicable today as it was when he wrote it. So, courtesy of Franklin’s Way to Wealth (1758), here are three timeless principles from one of our Founding Fathers:

On the topic of frugality and saving, Franklin wrote, “Beware of little expenses. A small leak will sink a great ship.” It is probably no surprise that Franklin put a lot of emphasis on frugality. After all, he was also the first to say, “a penny saved is a penny earned.” Importantly, though, Franklin didn’t believe in frugality as a virtue in and of itself. Rather, he was an advocate for frugality because it enabled savings. He was explicit about this. Expressing the modern-day idea of compound interest, Franklin wrote, “little strokes fell great oaks.”

The lesson: It’s easier to be frugal when you are doing it for a good reason — so that you can save — and you’ll be amazed at how those savings will grow.

On keeping up with the Joneses, Franklin wrote, “When you have bought one fine thing, you must buy ten more, that your appearance may be all of a piece.” Recognizing that it’s a never-ending treadmill to try to keep up with others, Franklin made a good observation: “It is easier to suppress the first desire, than to satisfy all that follow.”

The lesson: The easiest way to avoid getting stuck on that treadmill of keeping up with our neighbors is to avoid getting on in the first place. To put it another way, if you don’t show up in an Armani suit on Monday, no one will expect you to on Tuesday.

On avoiding complacency, Franklin cautioned against ever concluding that, “It is day, and will never be night.” Or, to put that in today’s terms, if the Dow Jones Industrial Average is at 21,000 and you feel like it will probably just keep going, be careful. Psychologists today have a term for this — the Recency Effect — and it’s important because we are all susceptible to it. That’s why market downturns catch virtually everybody by surprise.

The lesson: Always be sure that the asset allocation of your savings is aligned with your stage in life so that you are prepared for whatever the market brings next.

I hope you have a great holiday weekend.