I’m a big believer in transparency, so today I’d like to tell you a little about my own personal portfolio. As you might guess, the overwhelming majority of what I own is allocated to simple, low-cost index funds — the same things I recommend in my writing and for clients. That is true almost without exception. But today, I would like to describe for you one of those exceptions, because I think there’s something to be learned from it.

Many years ago, before I entered the investment industry, I purchased shares in a small mutual fund known as the Mairs & Power Growth Fund. Though it was a while ago, I still remember my reasons for choosing it: First, I had read about it in personal finance magazines, and it seemed to get good reviews. More importantly, I liked the fund’s strategy. They were located off the beaten path, in Minnesota, and they deliberately focused most of their investments in their local area. Among the fund’s longstanding holdings were companies like 3M and other household names. That seemed to make a lot of sense. And finally, I liked the firm’s conservative approach. They had been in business since 1931, but unlike most of their competitors, they had limited themselves to just two mutual funds. In short, they seemed like the kind of people who would stick to their knitting. And they did.

As it turns out, Mairs & Power has been among a minority of mutual funds that has delivered good performance over the years, so this investment happened to turn out well. Nonetheless, in hindsight, I don’t believe that this purchase made a whole lot of sense, and I wouldn’t do it again. Why not? Because there was no particular logic to the decision. I was early in my career, in a different industry, and I bought it because it seemed like a good fund run by good people. That was all true, but my mistake was this: I didn’t consider how it would fit into my overall financial goals.

What do I mean by that? I’ll try to relate it to something that we’ve all experienced: furnishing a new house or apartment. Setting up a new home is a lot of work, but it’s not terribly complicated: In the kitchen you’d want a table and chairs. In the family room, a couch, an easy chair and probably a TV. And so on. It’s intuitive and obvious. So obvious, in fact, that you’d never make a mistake like buying two kitchen tables or, alternatively, forgetting to put a bed in the bedroom.

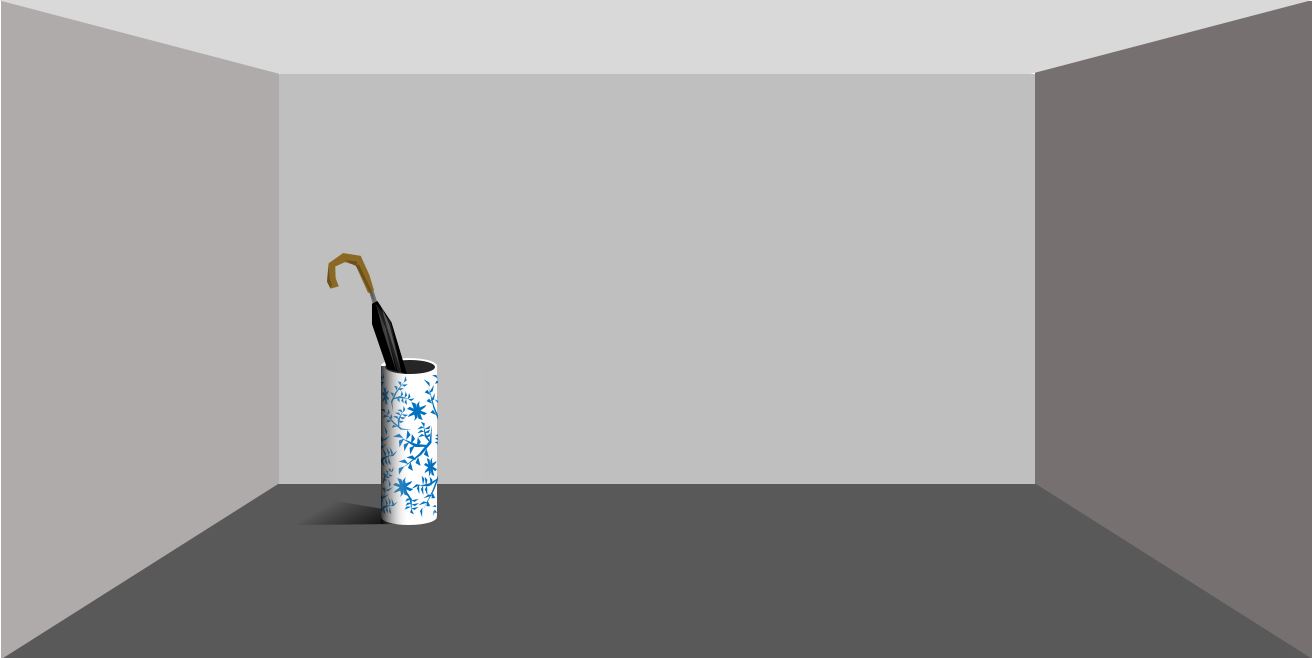

But, that’s exactly what I did when I bought that mutual fund. It was as if I needed to furnish an entire house but ended up buying just an umbrella stand for the front hall, and nothing else. Yes, it was a very nice and carefully-selected umbrella stand, but still just one random item.

The lesson: You should think about outfitting your investment portfolio in the same way that you think about outfitting your home. The first step is to spend time thinking through your needs. For example, are you saving for a tuition bill in three months, for a new car in three years or for retirement in three decades? The answer to this question will tell you how to “furnish” your portfolio. That is, it will guide you in choosing a coherent and complete set of investments so that you don’t end up with the equivalent of one lonely umbrella stand and nowhere to sleep.