When you were growing up, did you ever hear stories like this?

When you were growing up, did you ever hear stories like this?

“If you swallow gum, it will stay in your stomach for seven years.”

“If you keep making that face, it will freeze that way.”

“If you drink coffee, it will stunt your growth.”

“If you watch too much TV, your eyes will turn square.”

In hindsight, these stories are funny and harmless. But, problems can arise if, as adults, we make important decisions based on misinformation.

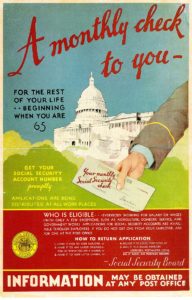

Within the world of personal finance, the topic that seems most susceptible to tall tales is Social Security. I regularly hear people attack it, arguing that it’s a Ponzi scheme or that it’s going to go broke.

While the program isn’t perfect, I believe that it is far better than its reputation suggests. Below are five common myths about Social Security, along with my views.

Tall Tale: Social security is going broke.

Fact: It is true that there are special trust funds that hold Social Security’s surplus tax revenue. However, those funds are not Social Security’s only source of funding. The reality is that Social Security is an obligation of the Federal government. Unlike a private company’s pension plan, the government will have to continue making payments whether or not there is any surplus remaining in those trust funds. Yes, in the future Congress could vote to reduce benefits, but the system cannot truly “run out of money.”

Tall Tale: It’s just a retirement plan.

Fact: While Social Security is best known for its retirement benefits, it also provides two other important programs: disability insurance and life insurance. With only a few exceptions, all three programs are available to every American.

Tall Tale: Since Social Security provides disability benefits, there’s no need for private disability insurance.

Fact: While Social Security does provide a disability program, I still recommend additional, private insurance. That’s because the bar is much higher to receive benefits from Social Security than it is from a private insurer.

Tall Tale: If I haven’t worked, I’m not entitled to any benefits.

Fact: Social Security was designed in an earlier era, when households typically had only one breadwinner. For that reason, the system will pay retirement benefits to both a retired worker and to that worker’s spouse, even if the spouse never worked. Importantly, this is a separate benefit, in addition to the worker’s own benefit, and does not reduce the worker’s own benefits. Benefits are also available to ex-spouses.

Tall Tale: I should sign up at my earliest possible opportunity.

Fact: No! Again, Social Security was designed in a different era, when life expectancies were shorter. As a result, the benefits get much more generous if you can wait. In general, your monthly check would permanently increase by 8% per year, plus inflation, for each year that you wait beyond your Full Retirement Age, up until age 70, at which point the benefits don’t increase further.

Also on the topic of retirement planning: If you have ever struggled through the endless list of investment options on your company’s 401(k) menu, you might find useful my three-step process for sorting through that complexity. I describe it in this article: www.humbledollar.com/2017/07/go-fish/

If you have questions about your own retirement plan, please feel free to call any time.