Some years ago my cousin Jim was hired by a local restaurant owner to serve as a “mystery shopper” in his own restaurant. Each week Jim would go to this restaurant, sit down for a meal and then report back to the owner on his experience. Not surprisingly, this restaurant, whose owner takes quality so seriously, has been around for decades and is an ever-popular destination.

But not every industry is as interested in feedback from their customers. Among them: the financial services industry. In fact, researchers from MIT and Harvard once used mystery shoppers themselves to evaluate financial firms, and the results were not flattering. Chief among their findings: Certain types of advisors steered clients toward high-cost products and generally “appeared willing to make their clients worse off in order to secure financial gain for themselves.” Another study, by researchers at Boston College, came to a similar conclusion.

As a consumer, how can you avoid these kinds of advisors?

The answer, I think, can be found in a recent article titled “The 19 Questions to Ask Your Financial Advisor,” by Jason Zweig, the Wall Street Journal’s personal finance columnist. What was the #1 question on Zweig’s list? “Are you always a fiduciary?”

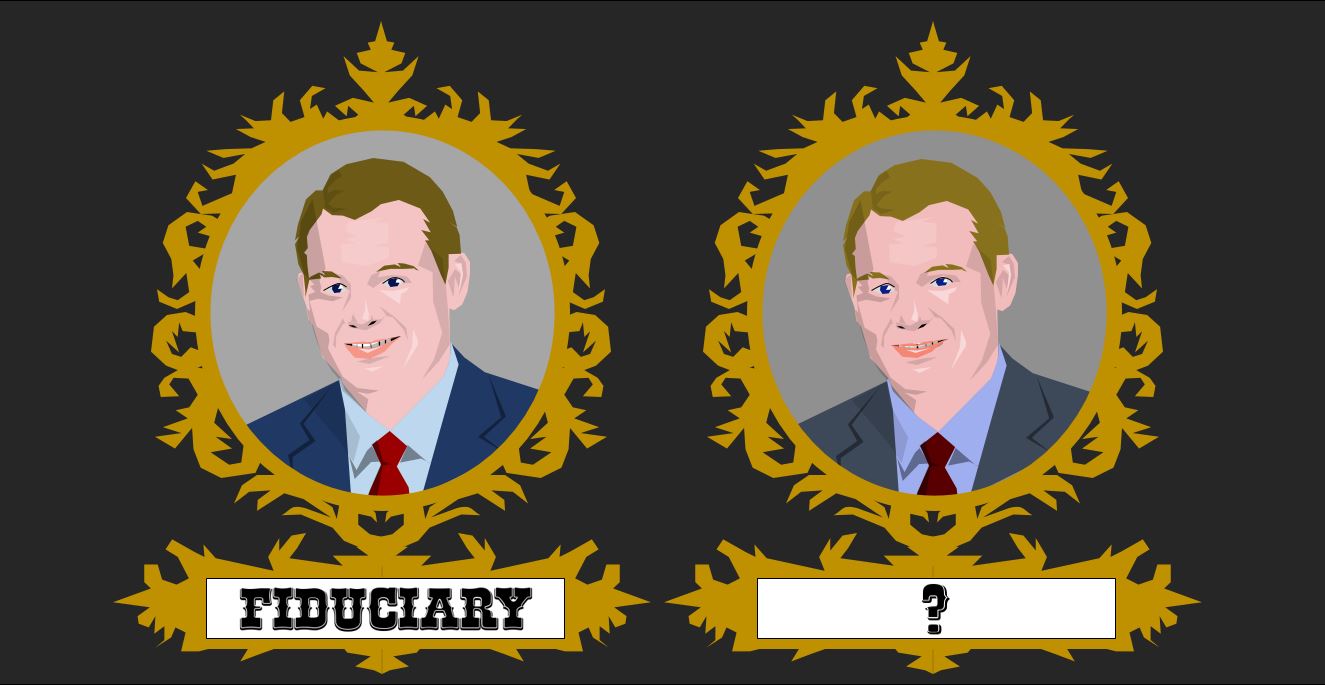

What does “fiduciary” mean exactly? In simple terms, it requires an advisor to put their clients’ interests ahead of their own. Now, you might expect that all financial advisors would be required to act in their clients’ best interest, but unfortunately that is not the case. In prioritizing this question, Zweig highlights a key distinction in the industry, which is that there are two categories of advisors out there: those who must act as fiduciaries at all times and those who do not.

Advisors who are not fiduciaries are held to a different, and looser, standard known as the “suitability” standard. The MIT professor who conducted the mystery shopper study articulated the difference between the fiduciary and suitability standards this way: “[It] is equivalent to simply prohibiting doctors from recommending drugs that kill you, while not actually requiring they prescribe the best drugs to cure your disease.” This was confirmed by the mystery shoppers. Advisors working under the fiduciary standard gave better advice than non-fiduciaries, making sure, for example, that clients were well diversified and invested in low-cost funds.

Unfortunately, it can be difficult to tell the difference between a fiduciary and a non-fiduciary, especially since both kinds of advisors can use similar titles on their business cards: Financial Advisor, Investment Advisor, Financial Planner, etc. In general, however, you can start with these rules of thumb:

If an advisor works for a brokerage firm — regardless of their job title — then that person is generally not a fiduciary and is subject only to the suitability standard. For years, the Federal government has been trying to change this, but even today, brokers must act as fiduciaries only in limited circumstances.

Similarly, if an advisor works for an insurance company, that person is not a fiduciary.

If an advisor works for what is known as a Registered Investment Adviser, or RIA, then that person is a fiduciary and is required to put clients’ interests first at all times.

If an advisor works for a bank or a trust company, then it depends, and you’ll want to do more research. At large banks, it is common to have multiple divisions. Some of these may operate under the fiduciary standard, while others do not. There’s no uniform rule, so you’ll want to follow the steps below to research a specific individual advisor by name.

Here are some additional ways to find out if your advisor is a fiduciary:

The first is simply to ask the advisor directly. Be sure, though, to phrase your question as Zweig recommended, asking if the advisor always serves as a fiduciary. That is because some advisors are permitted to take their fiduciary hat on and off, depending on the situation, and this can make things tricky for you as a consumer.

Another resource is the Financial Industry Regulatory Authority’s website, which has a searchable database of advisors: https://brokercheck.finra.org/. If the word “Broker” appears anywhere in the individual’s listing, be cautious. That person is not a fiduciary at all times.

If you’d like to learn more about this topic, John Oliver, host of the HBO show “Last Week Tonight,” provides an entertaining, though informative, explanation of the fiduciary vs. suitability distinction in this video (starting about six minutes in). An important caution, though: Oliver uses extremely salty language in this video, so it is not appropriate for all viewers.