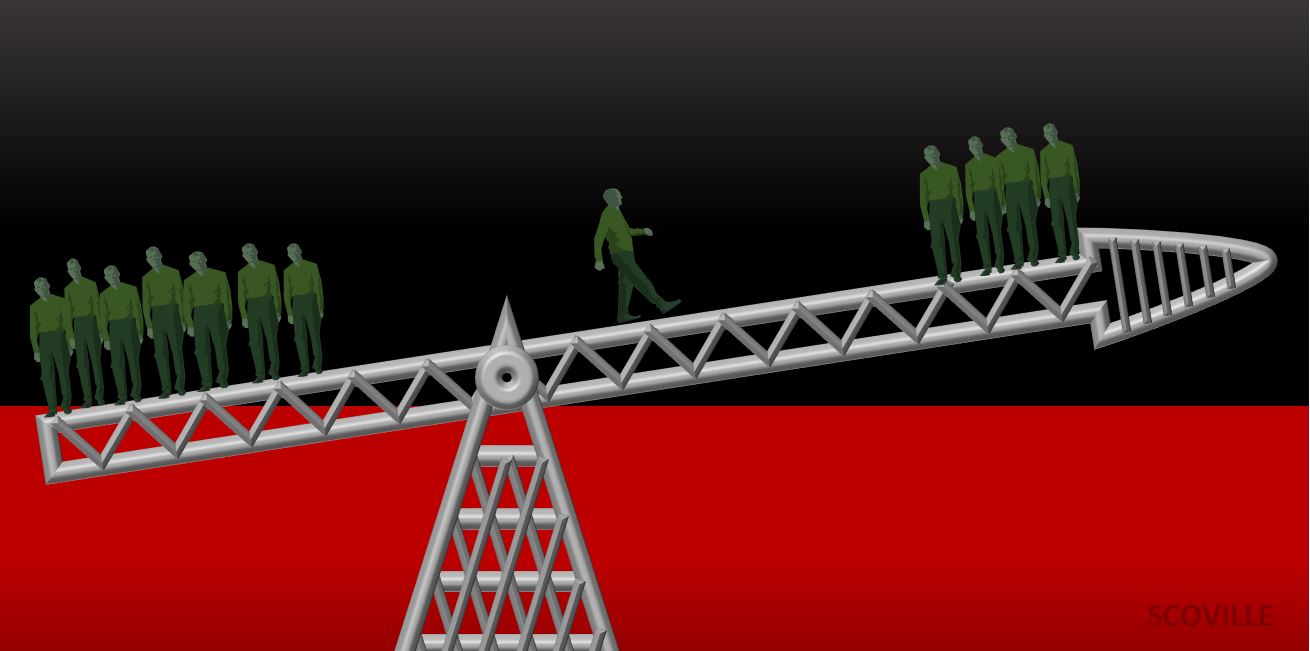

In the field of epidemiology, researchers have long used the term “tipping point” to describe how epidemics occur: At first, an ordinary disease moves slowly, not gaining much attention. But then, at a certain point, seemingly overnight, it snowballs into something much larger. Within the world of public health, this concept is well understood. But, about twenty years ago, the author Malcolm Gladwell took a closer look and pointed out that tipping points can be found in a whole host of other situations far beyond epidemiology. This certainly includes finance.

Consider, for example, the case of Lehman Brothers: In June of 2007, it reported a profit of more than $1 billion, a company record. And yet, by September of 2008, just fifteen months later, it was bankrupt and sold for scrap. Despite its sterling reputation, established over 158 years, the firm unraveled virtually overnight.

With the benefit of hindsight, there had been some early warning signs at Lehman. In its write-up of that record profit in mid-2007, The New York Times did mention a loss related to subprime mortgages — but it wasn’t until the eighth paragraph of the story. And even then, media reports quoted Lehman executives who described the issue as “small” and “contained.” There certainly was no indication that this “small” issue would bring down the entire company just a year later.

Why spend time talking about Lehman Brothers? While the particulars of that case are not generally applicable, I do think it’s worthwhile to understand it as an example — and not an isolated one — of financial tipping points. It is worth studying for the same reason that we study the Crash of 1929 or the Great Depression: They were unusual events, but they remind us to be sure we are taking the right steps today to avoid financial stress tomorrow. To that end, here are six ideas to help fortify your own finances for the long term:

1. Gather the facts. In the past, I have talked about the “Big Four” — your income and expenses, assets and liabilities. If you have a solid handle on all of these numbers, it’s an excellent starting point. Yes, there are other numbers that matter, but most financial questions can be answered by working just with those four.

2. If you don’t have these numbers readily available — and don’t have the time to gather them — consider hiring a bookkeeper. While some folks worry, justifiably, about privacy or about the risk of embezzlement, there are solutions. One excellent approach that addresses both concerns is to ask your accountant if they have a bookkeeper on staff who could do this work for you.

3. Once you have these numbers in hand, ask yourself two questions: Am I okay now? Will I be able to handle all of the financial obligations on the horizon, such as a home purchase, tuition or retirement? A simple set of financial projections like this may be extremely eye opening. And rest assured, in my experience this kind of exercise often ends up leaving folks sleeping better, not worse.

4. If you are employing one of the retirement rules of thumb, such as the “4% rule,” be sure that the rule you are using applies in your case. While rules of thumb can be helpful, they sometimes can be too simplistic, especially rules that are age-based — should Bill Gates really follow the same financial roadmap as every other 62-year-old? — so just be sure you understand the theoretical foundation for the rules you’re following.

5. If you want to virtually guarantee that you will never run out of money in retirement, there is one way to do it: Each year, simply limit your spending to a fixed portion of the value of your portfolio at the end of the prior year. For example, if you had $1 million at the end of last year, and your spending rule was 5%, then you would withdraw $50,000 this year, and no more. It’s worth noting that this is the way schools and colleges operate. As long as they stick to their spending rules, it serves them extremely well. But in exchange for this near-guarantee, there’s just one catch: If your portfolio declines in value in any given year, you have to be willing to take a “pay cut” the following year.

6. Recognize that there are lots of escape valves in our financial system. In Lehman’s case, their financial mess was beyond human comprehension, but when ordinary folks run into a simple cash crunch, there are lots of solutions. If you have Federal student loans, you could explore an income-driven payment plan, forbearance or refinancing. If tuition for your children is crushing your budget, call the bursar’s office. Colleges are businesses, and they will negotiate (even if they say they won’t). Even the IRS will be flexible: They have programs to pay both income taxes and estate taxes over a period of years.