I have to confess that I’ve never been a big fan of Victorian-era, long, plodding novels. However, Charles Dickens’s David Copperfield, published in 1850, contains a piece of timeless wisdom that I’d like to share with you.

The book’s central character is named Wilkins Micawber. A man with a cheerful attitude but unfortunate luck in his professional life, Micawber one day makes this observation:

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.

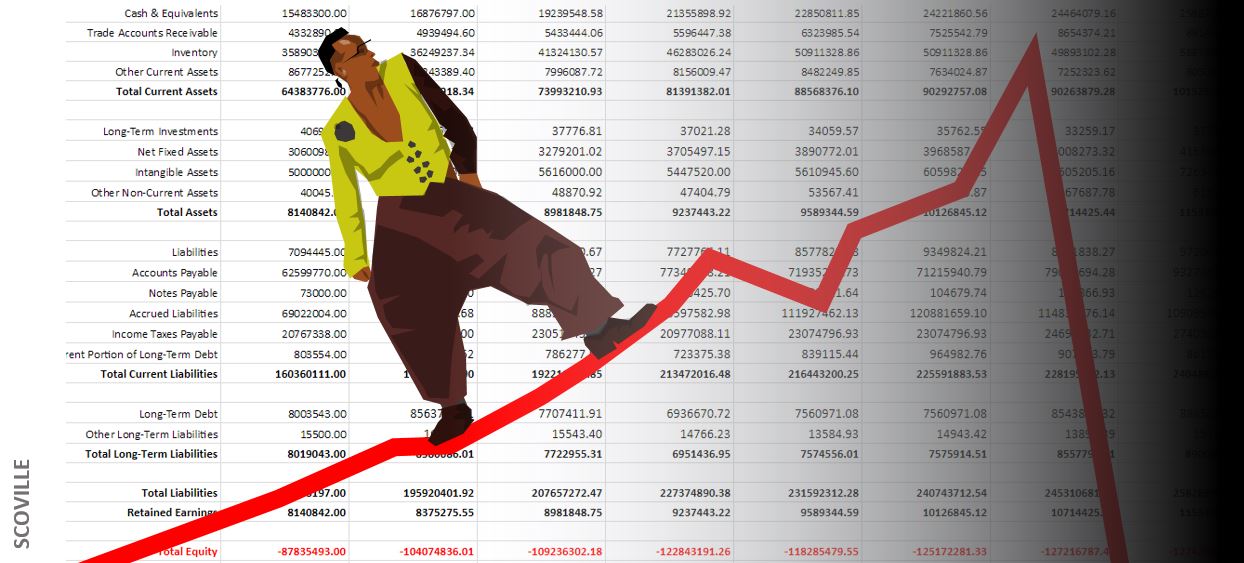

Mr. Micawber was a fictional character, but the phenomenon he describes is all too real. Recall, for example, the 1980s icon MC Hammer. When his music went to the top of the charts in the 1980s, Hammer made millions. But, unfortunately he also began spending millions. Among his extravagances, he employed a staff of two hundred, built a $30 million house and bought nineteen racehorses. The result, sadly, was bankruptcy.

It would be easy to judge Hammer harshly. After all, what kind of person needs a staff of two hundred? Wouldn’t one assistant have been enough? Or even two? In hearing this story, most people have a hard time sympathizing with Hammer. Clearly, he knew what he was doing, and so he shouldn’t have been surprised at the result.

I would like to argue, however, that Hammer actually does deserve our sympathy, and that’s because I really don’t think he knew what he was doing. His problem was exactly the same as Mr. Micawber’s — and lots of other people’s — only with more zeroes. The problem wasn’t a lack of income; it was a lack of proper financial planning. For example, if Hammer had spent just twenty million on his house instead of thirty, or bought just one Lamborghini instead of seventeen, he might have been just fine.

To hear Hammer tell it, he actually did think he had things under control. Yes, his staff numbered two hundred, but they each received a modest wage, so his total costs were less than $6 million a year. Now, that might still sound outrageous, but if you’re earning more than $30 million, as Hammer was at his peak, that would not have been a problem. Where he went wrong, though, was in not realizing that his income might decline over time.

Again, it would be easy to judge Hammer. What kind of person earning $30 million doesn’t put something in the bank for a rainy day? Who doesn’t realize that musicians’ careers don’t last forever?

Even though Hammer’s case is clearly extreme, I think it’s useful to understand because many — if not most — people struggle with these same kinds of questions. In fact, as a financial advisor, one of the most common questions I hear is, “can I afford this?” The fact is, even if you earn a substantial income, it’s still not always so easy to answer this question. For example, suppose you are in the top 1% of American incomes, earning $450,000. By all accounts, you should be in good shape, or even great shape. But, does that automatically mean you can buy a big house in the suburbs, put all your children through college and retire on time? The answer isn’t obvious. Hammer’s case was on a larger scale, but fundamentally, he was grappling with this same question.

The solution, in my view, is this: Even though it is difficult to plan with perfect accuracy, that doesn’t mean you shouldn’t plan at all. Even though the stock market is unpredictable, that doesn’t mean you can’t prepare to weather its inevitable ups and downs. In short, I believe that any plan is better than no plan at all. Financial plans need not be long or complicated. And, you should never feel that your plan must be carved in stone; you can always change course later. In fact, it may only be because you have a plan to begin with that you are aware of when it’s time to change course.

If you are unsure where to start in building a plan, you can download a simple planning template that I use with my clients and in the classes I teach. To use it effectively, you’ll want to sharpen your pencil, but my hope is that by taking the time to make a roadmap for yourself, you’ll have a greater chance of achieving what you want to achieve, and with a minimum of stress along the way.